Gifting made easy

With ScholarShare 529, anyone can make a gift of account contributions to your child’s college education. From grandparents and other family members to friends and neighbors, everyone can get in on helping your child reach their goals.

529 fact:

529 fact:

Contributions make the perfect gift for special occasions like birthdays or holidays.

Ugift®

Ugift offers a convenient way to give, receive and make special contribution requests.

Legacy and estate planning

Gifting larger amounts to a 529 account is a unique opportunity to support your loved one’s college education and contribute to your personal investments.

How do 529 plans work for legacy and estate planning?

For the tax year 2024:

- There’s no federal gift tax on contributions you make up to $18,000 per year if you’re a single filer, or $36,000 if you’re a married couple.

- You can also accelerate your gifting with a lump sum gift of $90,000 if you’re a single filer or $180,000 if you’re married and pro-rate the gift over 5 years per the federal gift tax exclusion.

- The ScholarShare 529 accounts are not subject to ‘Kiddie Tax’.

- You can gift this amount to as many individuals or beneficiaries as you like, free from income tax.

What are the federal estate and gift tax benefits?

If your estate exceeds the exempt amount, estate taxes can be quite high—in some cases more than 40%. Since contributions to ScholarShare 529 are considered a completed gift for federal gift and estate tax purposes, it’s removed from your estate, and can help reduce your future estate tax exposure. Plus, you can do this without incurring the federal gift tax as long as your contribution is within the current exclusion limits. This holds true whether you are the account owner or simply a contributor.

Relevant FAQs

Contributing to an existing ScholarShare 529 account is easy and secure with our online Ugift® platform. Gift contributions can also be made by check and mailed in. Check with your tax advisor.

For the tax year 2024:

- There's no federal gift tax on contributions you make up to $18,000 per year if you're a single filer or $36,000 if you're a married couple.

- You can also accelerate your gifting with a lump-sum gift of $90,000 if you're a single filer or $180,000 if you're married and prorate the gift over five years per the federal gift tax exclusion.

- You can gift this amount to as many individuals or beneficiaries as you like, free from income tax.

Consult your tax advisor for more details. Learn more about gifting.

There is no maximum ScholarShare 529 contribution limit. However, there is an overall maximum account balance limit of $529,000, which applies to all ScholarShare 529 accounts opened for a beneficiary. Accounts that have reached the maximum account balance limit may continue to accrue earnings.

Have the Franchise Tax Board deposit some or all of your refund directly into one or more of your ScholarShare 529 College Savings Plan accounts.

- Complete the Refund or No Amount Due section, line 115, of CA Form 540 to authorize Direct Deposit (line 32 of CA Form 540 2EZ)

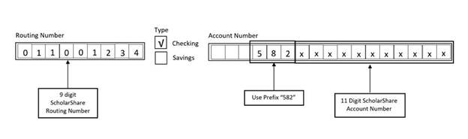

- Provide the ScholarShare 529 routing number (011001234)

- Select Checking for Type

- For Account Number use a prefix of 582 + your 11 digit ScholarShare account number. DO NOT use leading or trailing zeroes.

- See summary here:

More to explore

-

Explore our plan

Learn more about eligibility and all the qualifying expenses a ScholarShare 529 can cover.

How our 529 works -

Compare investment options

We make it easy to choose investment options that fit your financial needs and savings goals.

Discover your options -

Ready to get started?

Open an Account