Managing your ScholarShare 529 account

When it comes to making a financial decision, it’s important to ask questions. Here are the answers to some of our most common ones.

Additional Questions?

Read Our FAQsMost popular topics

Getting money into your account is one of the more frequent transactions you’ll make with your ScholarShare 529 account. Watch this guide on contributing to your account.

Withdrawing money from your account is one of the most frequent transactions you’ll make with your ScholarShare 529 account. Watch this guide for step-by-step instructions on how to make withdrawals from your account.

Gifting to a child’s 529 is a great way for friends and family to contribute to a child’s college savings. As an added bonus, they may be eligible to receive state tax benefits. Watch this guide on Ugifting to your ScholarShare 529 account.

Additional Questions?

Read Our FAQsAll Account How-Tos

Contributing & gifting

How to make contributions

One of the best aspects of ScholarShare 529 is that it’s easy to make contributions. There are many ways to add to the fund, including:

- A one-time electronic funds transfer

- Recurring contributions from a checking or savings account

- Automatic payroll deduction

- Rollover from another state’s 529 plan*

- Proceeds from a Coverdell Education Savings Account*

- Personal check, bank draft, cashier or teller’s check mailed to:

- Standard Delivery

ScholarShare 529

PO Box 219185

Kansas City, MO 64121-9185 - Overnight Delivery Only

ScholarShare 529

1001 E 101st Terrace, Suite 200

Kansas City, MO 64131

- Standard Delivery

ScholarShare 529 cannot accept cash contributions, starter checks, traveler’s checks, money orders, credit cards, convenience checks and some other forms of payment. Watch this guide on contributing securely to your account.

Footnotes

- *Be sure to consult with a qualified advisor regarding the possible legal and tax consequences associated with such changes.↩

Everyone wants to help a child succeed in life. One of the most unique features of your ScholarShare 529 account is the capability to ask for help from friends and family. Send them a Ugift® Invitation for a special occasion, like a birthday, holiday, graduation or one-time event, and help grow your account. As an added bonus, they may be eligible to receive state tax benefits.

How to ask for gifts

- After you’ve opened and set up online access for your ScholarShare 529 account, log in and select the Ugift link from the “My Accounts” page.

- Once you are on the Ugift page, a unique Ugift code will be provided for each account.

- Friends and family can use your Ugift code at any time to easily make gift contributions at Ugift529.com.

- You can share your Ugift code using Ugift’s email, Facebook, Twitter or printed party invitation inclusions. Another option for sharing is to print the Additional Contribution Form and mail it. See below for instructions on how to contribute a gift by mail.

Additional information

Account Owners will receive confirmation of any contributions to their accounts.

How to give a gift contribution by mail

- Download an Additional Contribution Form.

- Ask the account owner for the account number you should use for your gift, and list it on the form.

- Complete a check payable to ScholarShare 529.

Note: to ensure the contribution is deposited into the account, make sure the account number provided to you by the account owner is clearly indicated on the check as well as on the Additional Contribution Form. - Make a copy of your check and the form and keep them for your records.

- Mail your check and the completed forms to:

- Standard Delivery

ScholarShare 529

PO Box 219185

Kansas City, MO 64121-9185 - Overnight Delivery Only

ScholarShare 529

1001 E 101st Terrace, Suite 200

Kansas City, MO 64131

- Standard Delivery

ScholarShare 529 cannot accept cash contributions, starter checks, traveler’s checks, money orders, credit cards, convenience checks and some other forms of payment.

If you already have a college savings account, wonderful! You’re that much further ahead. And there’s more good news. With ScholarShare 529, you’re allowed to roll over the partial or complete balance from any other 529 plan into your account.

What you’ll need

To make this transfer, you’ll need:

- Your ScholarShare 529 account information

- The incoming account’s name, address and complete information

- The incoming beneficiary name and SSN if applicable

How to do it online

- Log in to your account online.

- Click on the desired account.

- Click “Rollover from another 529.”

- Select the Plan name of your existing 529 account and click “Submit”.

- Click “Download Form”.

- Complete all required information and print and sign the form.

- Mail the form and letter to the indicated address.

How to do it by mail

- Download and complete the Incoming Rollover Form.

- Select the Rollover Type.

- Verify and enter your ScholarShare 529 account information.

- Enter information on the current 529 Plan Manager or Coverdell ESA Custodian.

- Choose whether you’re transferring all or a portion of the assets.

- Check with your previous plan to confirm if they require a Medallion signature guarantee before submitting the form.

- Mail the completed form and you’re done!

Additional information

To make this change free of federal taxes and penalties, the plan you’re transferring funds from must have the same designated beneficiary or a qualifying family member as beneficiary. Consult your tax professional.

Where to mail forms

- Standard Delivery

ScholarShare 529

PO Box 219185

Kansas City, MO 64121-9185 - Overnight Delivery Only

ScholarShare 529

1001 E 101st Terrace, Suite 200

Kansas City, MO 64131

ScholarShare 529 cannot accept cash contributions, starter checks, traveler’s checks, money orders, credit cards, convenience checks and some other forms of payment.

With ScholarShare 529, you can roll certain existing educational accounts into your plan. For instance, if you’ve used a Coverdell account or U.S. savings bonds to pay for your child’s primary or secondary education, you can transfer any or all remaining funds to your ScholarShare 529. These transfers are also free from federal taxes and penalties as long as the beneficiary remains the same.

What you’ll need

To make this transfer, you’ll need:

- Your ScholarShare 529 account information

- The incoming account’s name, address, and complete information

- The former beneficiary’s name and SSN if applicable

- A printed copy of the Additional Contribution Form

How to do it

- Download and complete the Additional Contribution Form

- Be sure to verify your account information is correct.

- In section 2 of the form, Contribution Method, select Indirect Rollover and enter the Rollover Amount, Principal and Earnings.

- Mail the completed form and you’re done.

Additional information

For a Coverdell ESA, you must submit an account statement issued by the financial institution that acted as trustee or custodian of the Coverdell ESA that shows the principal and earnings portions of the redemption proceeds.

If you’re contributing amounts from a savings bond, you must submit an account statement or IRS Form 1099-INT issued by the financial institution that redeemed the bonds showing the interest portion of the redemption proceeds. Consult your tax professional.

Where to mail forms

- Standard Delivery

ScholarShare 529

PO Box 219185

Kansas City, MO 64121-9185 - Overnight Delivery Only

ScholarShare 529

1001 E 101st Terrace, Suite 200

Kansas City, MO 64131

ScholarShare 529 cannot accept cash contributions, starter checks, traveler’s checks, money orders, credit cards, convenience checks and some other forms of payment.

With ScholarShare 529, making regular contributions automatically is easy and worry free. Set up recurring contributions from your checking or savings account to your 529 plan in minutes. Once complete, you can change Recurring Contributions to your account at any time.

What you’ll need to do it online

To set up your automatic contribution plan online, you will first need to update your account information with the following information:

- Checking or savings account number

- Bank routing number

- Name as it appears on the account

- Bank’s name

How to do it online

- Log in to your account online. Once you’ve logged in, you will go directly to the Contribution page.

- Select “Electronically from your bank account.”

- Enter the contribution amount.

- Select “Recurring.”

- Select the Frequency and Start Date for the contributions.

- Choose if you would like to automatically increase this recurring contribution annually.

- Select the bank account, then click “Next.”

- Verify that the recurring contribution information is correct.

- Select “Submit” and you’re done.

If you work for a participating company or organization, saving for your ScholarShare 529 account just got even easier.

What you’ll need

Before setting up or changing your Payroll Direct Deposit, you’ll need to have your Employee Information, including:

- Name and Social Security number

- Employee ID number (if applicable)

- Employer name, address, and telephone number

- Contribution amount per pay period

- Starting date for deductions

How to do it

Step 1: First, be sure you’ve opened your ScholarShare 529 account online.

- Log in to your ScholarShare 529 account

- Click the “Profile & Documents” link on the My Accounts page.

- Click “Payroll Direct Deposit” on the left side.

- Click “Change payroll instruction” to start the process.

Step 2: Follow the prompts to select the amount to contribute from each paycheck, and how much to deposit for each beneficiary (if applicable).

- Once you submit this information, you must click “Get Form” and then print out the payroll form.

- This form will be pre-filled with your name, your unique account number, the total payroll deduction amount, and the routing (ABA) number for the Plan’s bank. If you are funding more than one account by payroll direct deposit, the amount per pay period should be the sum of ALL your payroll contributions to your ScholarShare 529 accounts.

Step 3: Submit the payroll form to your company’s human resources, benefits or payroll department. If your employer uses a self-service portal, complete the form with your information as you’d do when depositing a paycheck directly into your checking or savings account.

- Your employer will update the payroll direct deposit amount in the payroll system and will automatically send your contributions to ScholarShare 529.

- Be sure to inform your employer of any changes you wish to make to your payroll direct deposit contributions.

Have you received a tax refund, bonus, inheritance, or other lump sum you wish to put toward saving for college? To make a one-time electronic funds transfer from a checking or savings account to your ScholarShare 529 plan, follow these instructions.

What you’ll need

If you haven’t already set up your payment information, or if you wish to make this contribution from a different bank account, you will first need to update your account information with the following information:

- Checking or savings account number

- Bank routing number

- Name as it appears on the account

- Bank’s name

How to do it

- Log in to your account online. Once you’ve logged in, you will go directly to the Contribution page.

- Select “Electronically from your bank account.”

- Enter the contribution amount.

- Select “One Time Contribution.”

- Select the bank account.

- Select Next.

- Verify all contribution information is correct.

- Select “Submit” and you’re done.

Simplify regular contributions to your ScholarShare 529 account with the click of a button on the Bill Pay option using your own bank. Pay privately, securely and reliably. Save time and stay efficient by using your bank’s Bill Pay feature.

To set up your Bill Pay online with your bank, please use the following information:

- Name of Payee: ScholarShare 529

Address: PO Box 219185

Kansas City, MO 64121-9185 - Complete the memo line: Include the 11-digit account number.

- Recurring Payments: Some online Bill Pay services offer recurring (automatic) payments. Check with your bank on this option.

With ScholarShare 529, you get more ways to pay. Following your initial contribution, you can make an additional one-time payment using a personal check, teller’s check or cashier’s check.

How to do it online

- Log in to your account online. Once you’ve logged in, you will go directly to the Contribution page.

- Select “Mail a check” and click “Next.”

- Click “Get Form.”

- Click “Print Form.”

- Make the check payable to ScholarShare 529.

- Write your account number on the check in the memo line.

- Mail in the check and printed form.

What you’ll need to do it by mail

To make this payment, you’ll need:

- Your ScholarShare 529 account number

- Account owner name

- Beneficiary name

- A printed copy of the Additional Contribution Form

How to do it by mail

- Download and complete the form.

- Be sure to verify your account information is correct.

- Select the source of funds.

- Enter the amount, and for an Indirect Rollover the Principal and Earnings.

- Make the check payable to ScholarShare 529.

- Mail the completed form and you’re done!

Where to mail forms

- Standard Delivery

ScholarShare 529

PO Box 219185

Kansas City, MO 64121-9185 - Overnight Delivery Only

ScholarShare 529

1001 E 101st Terrace, Suite 200

Kansas City, MO 64131

ScholarShare 529 cannot accept cash contributions, starter checks, traveler’s checks, money orders, credit cards, convenience checks and some other forms of payment.

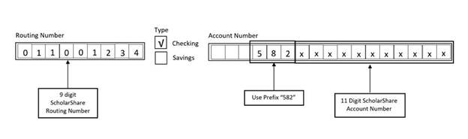

Have the Franchise Tax Board deposit some or all of your refund directly into one or more of your ScholarShare 529 College Savings Plan accounts.

- Complete the Refund or No Amount Due section, line 115, of CA Form 540 to authorize Direct Deposit (line 32 of CA Form 540 2EZ)

- Provide the ScholarShare 529 routing number (011001234)

- Select Checking for Type

- For Account Number use a prefix of 582 + your 11 digit ScholarShare account number. DO NOT use leading or trailing zeroes.

- See summary here:

Withdrawals & expenses

Only the account owner may make a withdrawal. You can request a withdrawal by mail, by phone, or from the Plan’s website. Withdrawals may be made individually or systematically. You can pay the institution, send it directly to the beneficiary or reimburse yourself. Be sure to keep all receipts to substantiate qualification.

Type of withdrawals:

- Qualified Withdrawals: These are untaxed and include any withdrawals that will be used to cover Qualified Higher Education Expenses for the student at an Eligible Educational Institution. The student must be enrolled for at least half-time for room and board expenses. Qualified higher education expenses also include tuition expenses of up to $10,000 per year per beneficiary in connection with enrollment and attendance at an elementary or secondary public, private or religious school, student loan repayment up to $10,000 per beneficiary, and expenses for apprenticeships and California Concurrent Enrollment.1

- Taxable Withdrawals: The earnings portion of this type of withdrawal is subject to federal and state tax but does not include the additional federal 10% tax. Say your child receives a full or partial scholarship or attends a military academy, you can withdraw certain amounts from your 529 account that will not be used for qualified higher education expenses, and those amounts will be subject to tax on the earnings portion of the withdrawal but will not be subject to the additional federal 10% tax.

- Non-Qualified Withdrawals: The earnings portion of this type of withdrawal will be subject to tax, including the additional 10% federal tax. Examples might include using the money for a car, vacation or home improvement. But even if you urgently need to pay a medical bill and withdraw money from your 529 plan as a last resort—that withdrawal would still be subject to tax, including the additional 10% federal tax.

Footnotes

- 1In the event of a refund of amounts paid for qualified higher education expenses from an eligible educational institution, the refund may be redeposited to the 529 plan within 60 days without the amount being subject to tax. The recontributed amount cannot exceed the amount of the refund.↩

Are you getting ready to withdraw funds for the first time? If so, you’ll find you can make a withdrawal online or by mail. Here’s a few other points to consider. Withdrawals fall into three categories: qualified, taxable and non-qualified. Only qualified withdrawals may be made without federal income tax or penalties.

What you’ll need for an online withdrawal

If you haven’t already set up an account to receive the funds, for either yourself or the beneficiary, you will need to update your account information with the following details:

- Checking or savings account number

- Bank routing number

- Name as it appears on the account

- Bank’s name

Without an active, up-to-date account, you may only receive the funds through a check. You’ll also need to wait eight days after the receipt of a contribution before you can withdraw the funds from your account.

Here’s some other important things to consider:

- If you change your mailing address, you won’t be able to make a withdrawal for 20 business days

- If you change banking information, you won’t be able to make a withdrawal for 30 days

- If you add a new bank account, you won’t be able to make a withdrawal for 30 days

- If you transfer the account to a new owner, no withdrawals may be made for 30 days

Additional requirements may apply to requests of $100,000 or more.

How to do it online

- Log in to your account online. Once you’ve logged in, you will go directly to the “Withdrawal” page.

- Select the type of withdrawal you plan to make:

- qualified withdrawal

- withdrawal to pay expenses for tuition in connection with enrollment or attendance at an elementary or secondary public, private or religious school

- withdrawal for Student Loan expenses

- withdrawal for Apprenticeship expenses

- non-qualified withdrawal

- Select where the funds will be sent:

- Directly to the college or school – Select the state where the school is located and the school, and if the funds should be sent via electronic payment or by check

- If electronic payment: Verify or enter the mobile phone number to receive text updates, or opt-out of receiving text updates

- If check: Select the delivery speed, enter the college name and address, and type the student ID in the check memo field

- Owner – Select bank account and certify, or if by check, select the delivery speed and complete the check memo

- Beneficiary - Select bank account and certify, or if by check select the delivery speed and complete the check memo

- Directly to the college or school – Select the state where the school is located and the school, and if the funds should be sent via electronic payment or by check

- For funds sent to the Owner or Beneficiary, select “Partial” or “Total” account balance withdrawal.

- If you have more than one investment option, select “Prorated amount” or “By specific portfolio.”

- Enter the withdrawal amount(s).

- For funds sent directly to the college or school, enter the school’s required information.

- Verify the withdrawal information is correct (type, delivery method, investment options and amount).

- Select “Submit” and you’re done.

What you’ll need to make a withdrawal by mail

A printed copy of the Withdrawal Request Form. If you wish to withdraw funds by Automated Clearing House (ACH) to an Account Owner’s bank account (already on file), you will need to provide the bank name and account number.

How to do it by mail

- Download and complete the Withdrawal Request Form.

- Be sure to verify your account owner and beneficiary information entered is correct.

- Select/enter the Withdrawal Details.

- Select the Delivery Method, if applicable.

- Select/enter the Amount of Withdrawal. For Partial Fund Specific, enter the Investment Options you want to withdraw the funds from, and enter an amount or select Total Balance.

- Sign, date and mail the completed form and you’re done.

Where to mail forms

- Standard Delivery

ScholarShare 529

PO Box 219185

Kansas City, MO 64121-9185 - Overnight Delivery Only

ScholarShare 529

1001 E 101st Terrace, Suite 200

Kansas City, MO 64131

ScholarShare 529 cannot accept cash contributions, starter checks, traveler’s checks, money orders, credit cards, convenience checks and some other forms of payment.

You can make systematic (recurring) withdrawals to pay for your beneficiary’s qualified higher education expenses. If you establish a systematic withdrawal plan, you may change or cancel it at any time.

How to do it online

- Log in to your account online and click on the desired account.

- Click the “Manage systematic withdrawals” link.

- Click the “Set up a systematic withdrawal plan” button.

- Select the frequency, start date, stop date and withdrawal day.

- Select where the funds will be sent:

- Account Owner: Select the bank account and certify, or if by check, complete the Check Memo

- Beneficiary: Select bank account and certify, or if by check, complete the Check Memo

- College or university: Enter the college name and address, then enter the Student ID in the Check Memo field

- Click “Next.”

- Enter the systematic withdrawal amount.

- Click “Next.”

- Verify the systematic withdrawal information.

- Submit and you’re done.

To request a rollover to a Roth IRA, please first contact your Roth IRA administrator to determine their ability and requirements to receive the rollover. Then, submit any required Roth IRA form available from your Roth IRA administrator and the ScholarShare 529 Direct Rollover Out to Roth IRA form to ScholarShare 529.

Managing your account

With ScholarShare 529, log in to view account statements and recent activity online at any time… or grab important documents like tax reports. It’s all as simple as logging in.

How to do it

- Log in to your account online.

- Once you’ve logged in, you will go directly to the “Statements, Confirms & Tax Forms” page.

- You can search by year, beneficiary and document type.

- Click on a document link to view or print it.

Additional information

If you take a withdrawal from your ScholarShare 529 sometime during the tax season, you will likely receive a 1099Q for any withdrawals made the previous year. This tax document includes the total of all withdrawals you make during a given year and may be taxable depending on the withdrawal type.

When a withdrawal is placed:

Payable to the Account Participant (The Account Owner will be the tax responsible party who will receive the IRS Form 1099-Q).

Payable to the Designated Beneficiary (The Beneficiary will be the tax responsible party who will receive the IRS Form 1099-Q).

Withdrawal to an eligible college or university, or secondary public, private or religious school (The Beneficiary will be the tax responsible party who will receive the IRS Form 1099-Q).

Indirect Rollover (The Account Owner will be the tax responsible party who will receive the IRS Form 1099-Q).

1099Q’s are sent to the responsible parties above dependent on delivery preference by January 31 of the year following that in which the withdrawal was done (e.g. if a withdrawal takes place in 2023, the 1099Q would be generated and be delivered on or before January 31, 2024).

At some point, you may find you want to transfer ownership of your account to another individual or entity eligible to be an Account Owner. You can make this transfer by submitting the appropriate Plan form. This in effect opens a new account for the beneficiary with the new owner. It’s important to note, depending upon who the new owner is in relation to the beneficiary, taking this action can have various tax implications.

What you’ll need

To complete this process, you do not need to change the beneficiary if you transfer account ownership, but you’ll need:

- Your ScholarShare 529 current account information

- The new owner’s name, SSN, address and contact information

- A printed copy of the Transfer Form.

How to do it by mail

- Download and complete the Transfer Form.

- Be sure to verify your account information is correct.

- Include the new account owner’s information.

- Select the investment options you wish to transfer, including the amounts.

- Mail the completed form.

Additional information

A transfer of the ownership of an account will be effective only if the assignment is irrevocable and transfers all rights, title and interest in the Account.

Where to mail forms

- Standard Delivery

ScholarShare 529

PO Box 219185

Kansas City, MO 64121-9185 - Overnight Delivery Only

ScholarShare 529

1001 E 101st Terrace, Suite 200

Kansas City, MO 64131

ScholarShare 529 cannot accept cash contributions, starter checks, traveler’s checks, money orders, credit cards, convenience checks and some other forms of payment.

Over the lifetime of your account, you’ll probably need to change contact information, bank instructions, notifications, password and security questions. With ScholarShare 529, you can do all of it in one place online or fill out and mail in the form.

How to do it online

- Log in to your online account

- Go to your Profile page to change any of the following information:

- Account Owner contact information and email address

- Bank information

- Payroll direct deposit

- Account notification preferences (mail or eDelivery)

- Password & security features

- Beneficiary contact information

- Successor owner

- Authorized agents / Interested parties / Trusted contacts

- Enter your new information in the related fields and complete any additional instructions.

- Submit all changes to complete your account updates.

Depending upon when you open your ScholarShare 529 account, you will likely have it for years, even decades. If you didn't add a successor participant when your account was opened, you may want to designate one in the event of your death or change the existing successor participant as your life situation changes. For instance, say you’re a parent who put your child through school and now they’re starting a family of their own. If there are funds remaining, you may designate your child as the successor participant to use for their family.

What you’ll need

If adding or removing a successor participant, you’ll need:

- The successor participant's full name, date of birth and SSN

- A printed copy of the Profile Change Form (if updating by mail)

How to do it online

- Log in to your online account.

- Go to your Profile page and click on “Successors.”

- Enter your new information in the related fields and complete any additional instructions.

- Submit all changes to complete your account updates.

How to do it by mail

- Download and complete the Profile Change Form.

- Be sure to verify your account information is correct.

- Update the relevant participant, successor participant or beneficiary information.

- If required, include a Medallion signature guarantee before submitting the form.

- Mail the completed form.

Where to mail forms

- Standard Delivery

ScholarShare 529

PO Box 219185

Kansas City, MO 64121-9185 - Overnight Delivery Only

ScholarShare 529

1001 E 101st Terrace, Suite 200

Kansas City, MO 64131

ScholarShare 529 cannot accept cash contributions, starter checks, traveler’s checks, money orders, credit cards, convenience checks and some other forms of payment.

If you wish to add a ScholarShare 529 account for an additional beneficiary, it’s as simple and straightforward as opening your first account. You can complete the process online.

What you’ll need

Before adding a new account for a new beneficiary, you’ll need:

- The new beneficiary’s name, date of birth and SSN

- Their home address and contact info

How to do it online

- Log in to your account then select the “Enroll” link.

- Select the type of account (Individual or UGMA/UTMA).

- Enter the new beneficiary’s info, including name, date of birth, SSN and address (if different from yours).

- Select the preferred investment options and funding choices.

- Submit all changes to complete your account updates.

After opening an account, you may still designate a new beneficiary without penalty, so long as it’s an eligible family member of the former beneficiary.

What you’ll need

- To complete this process, you’ll need:

- Your ScholarShare 529 current account information

- The new beneficiary’s name, SSN, address and contact information

- A printed copy of the Transfer Form

How to do it by mail

- Download and complete the Transfer Form.

- Be sure to verify your account information is correct.

- Include the new beneficiary’s full information.

- Select the investment options you wish to transfer, including the amounts.

- Mail the completed form.

Where to mail forms

- Standard Delivery

ScholarShare 529

PO Box 219185

Kansas City, MO 64121-9185 - Overnight Delivery Only

ScholarShare 529

1001 E 101st Terrace, Suite 200

Kansas City, MO 64131

ScholarShare 529 cannot accept cash contributions, starter checks, traveler’s checks, credit cards, convenience checks and some other forms of payment.

Managing your investments

While there are Enrollment Year Investment Portfolios that offer a simple, all-in-one portfolio, you may be using another investment choice or find you want to change investment portfolios anyway.

Twice per calendar year, you may opt to redistribute existing funds among your various investment portfolios. You can manage this online.

How to do it online

- Log in to your account online, then select the account you’d like to update.

- Select “Change investment options” and then “Continue” in the “Exchange Now” section of your account profile.

- Update the percentages for your new asset allocation according to your preferred investment portfolios.

- Confirm any changes to your “Allocations for Future Contributions” for the new asset allocation percentages.

- Click “Next,” then verify the exchange information.

- Submit all changes to complete your account updates.

Though you can only rebalance existing investments twice per year, you can direct new contributions to different investments by changing your allocations for future contributions any time through your online account.

How to do it online

- Log in to your account online, then select the account you’d like to update.

- Click “Change investment options.”

- Scroll down to “Your Current Investment Options” to review your current allocations for future contributions.

- Click “Continue” in the Allocations for Future Contributions section.

- Enter New Instruction percentages for each investment portfolio you want to make future contributions to and click “Next.”

- Verify your current and new allocations for future contributions information.

- Submit all changes to complete your account updates.

You can exchange from one portfolio to other portfolio(s) on a recurring basis.

Setting up automatic dollar cost averaging online, or by using the Account Features Form, will count as one of your two allowed exchanges per calendar year.

How to do it online

- Log in to your account online, then select the account you’d like to update.

- Select “Change investment options,” then click “Continue” in the “Automatic Dollar Cost Averaging” section.

- Select your preferred source portfolio, start date, run day, frequency and stop criteria.

- Enter dollar amounts for your target portfolios.

- Click “Next” and then verify the recurring exchange information.

- Submit all changes to complete your account updates.

More to explore

-

Give a gift

Contribute to a ScholarShare 529 or request a gift through our Ugift® platform.

Start gifting -

The cost of college

Get information to help you plan and save for rising tuition, fees, and other college expenses.

Find out more -